Intelligent Extraction

AI-powered extraction of critical data from complex financial documents, transforming unstructured information into structured, actionable insights.

Extract What Matters Most

Financial documents contain vast amounts of unstructured data buried within thousands of pages. Our intelligent extraction technology uses advanced natural language processing and machine learning to automatically identify, extract, and structure the most critical information from SEC filings, contracts, and regulatory documents.

Traditional manual extraction is time-consuming, error-prone, and doesn't scale. Our AI-powered approach processes documents in seconds, maintaining accuracy while dramatically reducing research time.

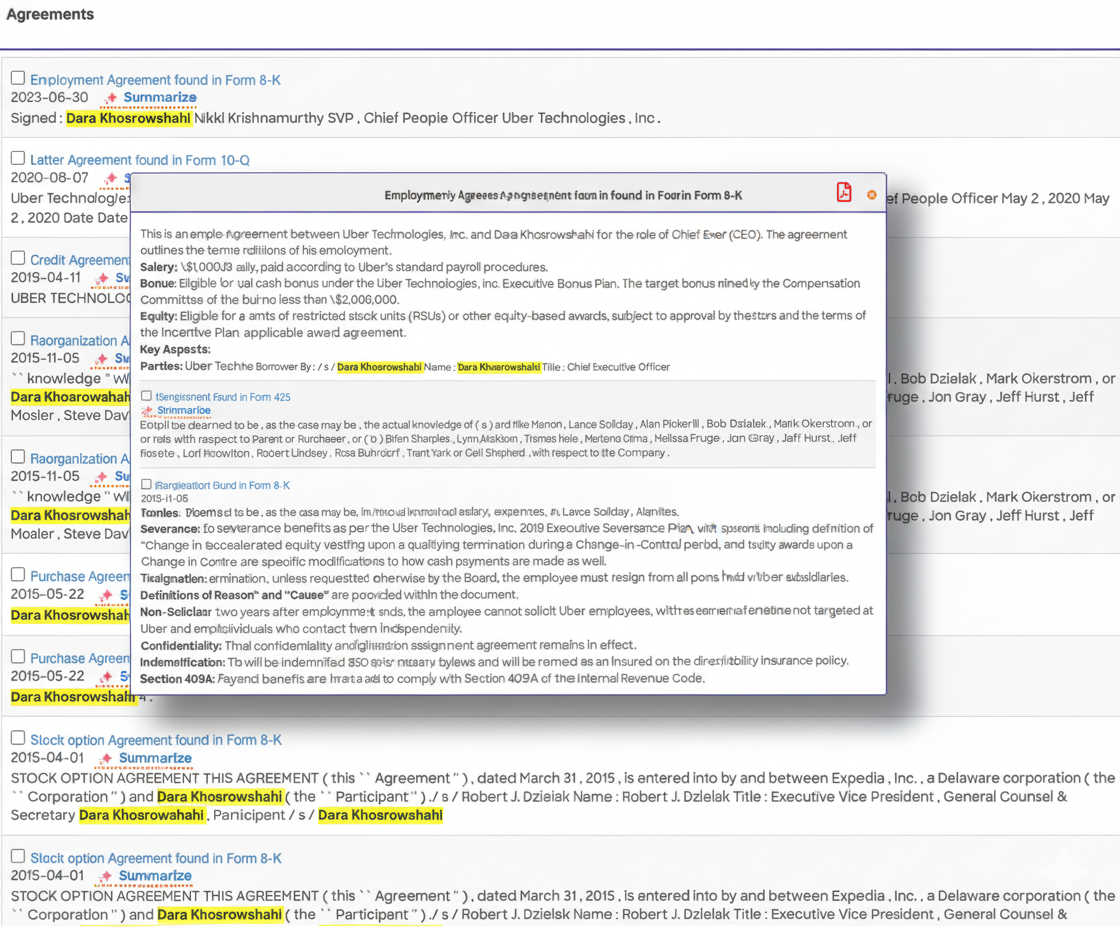

- Filing Sections & Exhibits – Automatically identify and extract specific sections like Risk Factors, MD&A, Financial Statements, and all material exhibits from 10-K, 10-Q, 8-K, and proxy filings.

- Agreement Clauses – Parse complex legal agreements to extract key terms, conditions, payment structures, termination clauses, and material obligations from merger agreements, credit facilities, and commercial contracts.

- Wealth & Compensation Data – Extract executive compensation details, stock ownership, insider holdings, beneficial ownership tables, and wealth concentration metrics from proxy statements and Form 4 filings.

- Financial Metrics – Pull revenue segments, geographic breakdowns, subsidiary information, debt covenants, and KPIs directly from financial statements and footnotes.

- Risk Disclosures – Identify and categorize risk factors, legal proceedings, regulatory investigations, and material uncertainties across all filings.