Spoiler alert! The growing pushback from activist investors towards corporate management is becoming more evident, with over 732 filings in the past 12 months providing insight into ongoing Board-level conflicts. The historic date of March 6th, 2024, marked a record-breaking number of proxy fight submissions to the SEC EDGAR system.

So why do you care? Because the spheres of inflluence at the Board level may change significantly and your donor or prospects could be on the chopping block. That said, the success of the ‘coup’ won’t be evident until the company issues the proxy voting results in an 8-K Item 5.07, usually 45 days after the annual meeting.

What’s an activist investor? And why should you care about their push-back on public companies? How will a Proxy fight impact fundraising?

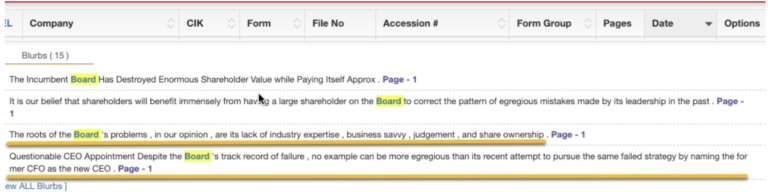

Firstly, activist investors are exactly that – activists. Their main goal is to shake things up within a company by acquiring a significant amount of common stock (>5%) to ensure their voices and opinions are heard at the Board level. When these investors become dissatisfied with their returns or the company’s policies, things can get messy. Press releases start flying, open letters to shareholders are filled with colorful descriptions of the issues at hand, and yes, names are called out and alleged failings are pointed out. These filings, unlike most SEC documents, make for quite an interesting read. Kaleidoscope users stay on top of this information by setting up alerts for FORMs DFAN14A and DFRN14A.