New Rules for Activitst Investors (SC 13D)

Filing deadlines. According to the newly adopted final rules, activist investors will now be obligated to disclose any 5% position on Schedule 13D within five (5) business days of reaching the threshold. Furthermore, any amendments to the disclosure (SC 13D/A) must be made within two (2) business days, which is half the time previously allowed.

- Today’s rules also clarify the Schedule 13D disclosure requirements related to derivative securities that large investors have used to obtain effective control over large blocks of company stock without any public disclosure. The new rules provide a framework for determining when an investor’s use of certain cash-settled derivative securities result in the person being treated as a beneficial owner.

- Also, *Item 6 of Schedule 13D requires the investor to disclose interests in all derivative securities, including cash-settled derivative securities, that use the issuer’s equity security as a reference security. (*Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer)

New Rules for Passive, Institutional Investors (SC 13G)

Filing Deadlines. New rules accelerate the Schedule 13G beneficial ownership reports, depending on the type of filer, to 45 days after a calendar QUARTER ENDS providing issuers with a more timely record of institutional investment. New rules also accelerates amendment (SC 13G/A) obligations when the level of beneficial ownership exceeds 10 percent (10%) or increases or decreases by 5 percent ( +/- 5%).

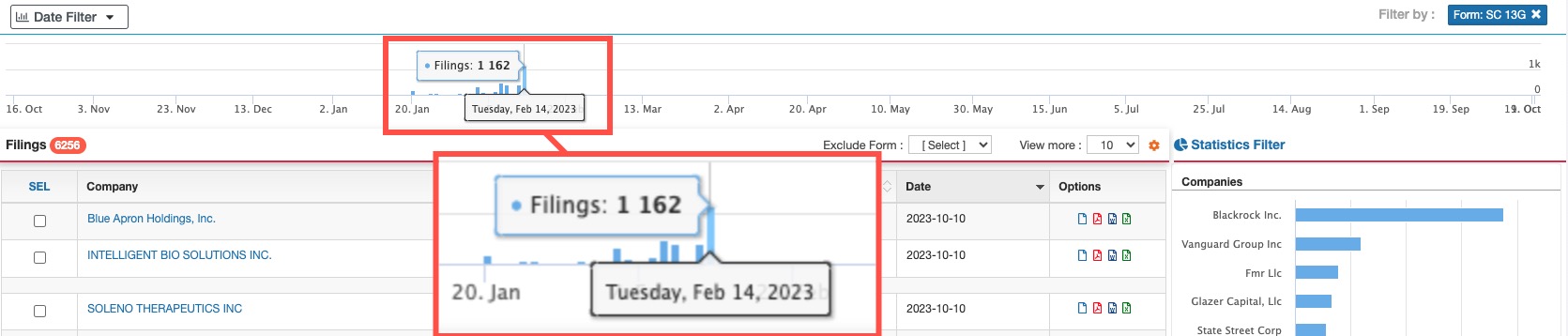

The current filing requirement of 45 days after the end of a calendar year leads to a significant influx of filings in the system between January 15th and February 15th each year, as depicted in the image below. This leaves issuers with limited time to assess the beneficial ownership situation before the publication of the definitive proxy statement (DEF 14A) and the annual shareholders meeting.