2023 Bank Meltdown. Silicon Valley Bank . . . Silvergate Bank, Signature Bank. . .and more.

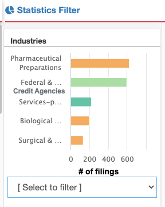

What do these three banks have in common? No, it’s not because their names all start with “S”. They’ve all failed in March 2023. Affecting 49 industry sectors, primarily pharmaceutical preparations, and biologics.

FDIC has stepped in for SVB, but what happens to the outstanding credit lines and loans by companies domiciled in Canada, US, Ireland, UK, Switzerland and Germany? What’s the downstream effect? Lack of liquidity. Below are just a few excerpts from SEC filings that illustrate the difficulty companies may be facing in the near future.

“Additionally, our ability to pay dividends on our common stock is limited by restrictions under the terms of our credit agreement with Silicon Valley Bank. “

“We intend to use the net proceeds from this offering for general corporate purposes, including the acquisition of bitcoin … and for the repayment of our outstanding indebtedness under a secured term loan pursuant to a Credit and Security Agreement between our wholly-owned subsidiary and Silvergate Bank.”

“Strong performance in the insurance sub-sector … was offset by underperformance in the Portfolio’s regional bank holding, Signature Bank.”

Many of the loan agreements with SVB have a recurring theme, which is collateralization of all the assets of the company receiving the loan.

Which companies have loans and when are they due?

Which Investment Companies have exposure?

Download the lists!

Is there more to come? Check out this article as well.

According to Wikipedia, “On March 13, shares of regional banks fell.[53] Shares of San Francisco-based First Republic Bank fell by 67%.[53] Western Alliance Bancorporation share price fell 82% and PacWest Bancorp was down 52% before their trading was halted.[54] “ .