One of the key elements of fundraising is having an up-to-date and accurate understanding of changes in a potential donor’s financial situation. This information is critical to the timing of an “Ask”. Our clients are clear about the necessity for timely and accurate data. So, let’s review a few elements that top this list for timing the ‘Ask’. . .

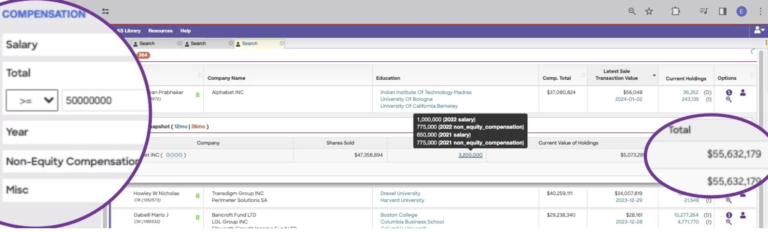

Capacity for Cash Gift. Does the donor have capacity for cash donation? Cash compensation, annual bonus, non-equity incentive programs, eligibility for corporate matching gift programs and recent stock sales all add up to liquid capacity. Insider Focus calculates cash compensation, net value of recent stock sales and identifies corporate matching gift programs.

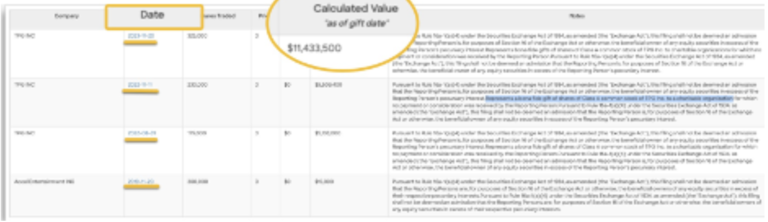

Historical Stock Gifts. Does the donor have the affinity for giving? Has the donor gifted stock before? When did that occur? How much was the gift worth? Insider Focus reveals the dates, calculated values and footnotes from Form 4s.

Current Stock Holdings. What’s the ‘health’ donor’s current stock holdings? What happened to the stock after the merger?

Alerts on Events. Keep up-to-date with companies, donors, and prospects by receiving real-time alerts on news mentions of individuals, changes in compensation, additional stock awards, promotions, appointments, employment agreements, and more.

All members of the Advancement teams can easily view past, present, and potential future wealth and gifting trends. This comprehensive view of donors’ financial situation allows development officers to make informed decisions regarding fundraising efforts.

They can identify donors with stock options that are exerciseable or nearing expiration, evaluate the basis point compared to the current stock price, and track the cash compensation trends. Armed with this knowledge, development officers can time their ‘ask’ effectively and maximize the potential for charitable gifting.

Especially designed for prospect researchers and advancement teams to access real-time wealth data, bios and business affiliations disclosed in SEC, your teams can extracts all relevant information from various types of filings, transactions, and proxy statements. In addition to data on merger prompted tender offers, employment or severance agreements and more, teams are eliminating hours of web surfing collecting specific wealth data from multiple websites.

Interactive links guide researchers to the exact data, with our expert Kaleidoscope team ready to support. Interested in a free trial or demo of Insider Focus? Connect with our team here.