One of the key benefits of leveraging SEC filings is the ability to analyze past, present, and future insider wealth trends. By examining historical data, researchers can identify compensation trends, stock gift values and cycles of giving, which can impact fundraising strategies. This type of ‘surfaced’ analysis provides valuable insights into donors’ wealth accumulation over time and their potential for future contributions.

Raking through multiple SEC filings can be time consuming and frustrating, at best. How about a ‘short-cut’ for staying up-to-date on individual insiders or a watchlist of people? Note: Most commercial prospect research tools on the not-for profit market space provide delayed information on only Form 4 insider transactions. Let’s identify key elements to success contained in SEC filings.

- Past: Salary history and past stock sales are summarized to show trend patterns of increases or decreases. But dredging through proxy statements, insider filings, annual reports, proxy statement, potentially merger filings and tender offers may take a while. Insider Focus does this for you and displays the accurate aggregate.

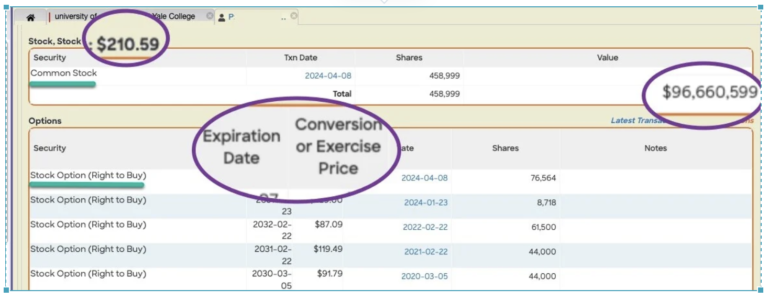

- Present: By cross-referencing yesterday’s stock price, Insider Focus calculates a summary of wealth as disclosed in SEC filings, for donors or a group of prospective donors. Re-sort the results to identify and screen those who are in a favorable financial position to make significant contributions.

- Future: What’s in a prospect’s back pocket? GRATs? DAFs? Trusts?Unvested stock awards? Unexercised stock options, the exerciseable date, and expiration date? Future vesting dates of Options and RSUs and PSUs? Annual bonus targets and potential cash income? These valuable details are available through Kaleidoscope’s Insider Focus.

Stay Ahead of Liquidity Events with Alerts on names, alumni lists, watchlists, and keywords or phrases, to enable advancement teams to adopt a proactive approach to fundraising. Liquidity events like pre-merger announcements, stock repurchases, and future vesting dates play a crucial role in strategically timing donation requests for effective campaigns and prospect development. Taking a proactive approach not only boosts the chances of success but also fosters stronger relationships between non-profit foundations and their donors.

Request a Demo today, and let us show you how to benefit from a proactive approach.